Good Reads

Inflation or Deflation?

Some people are worried that debt and deficits and money printing are going to cause inflation to skyrocket. Other people are worried that AI and technology are going to cause us to go deep into deflation. Jared Dillian acknowledges that there are both inflationary and deflationary forces, and believes they will probably offset each other, leading to inflation of about 3%. Read on »

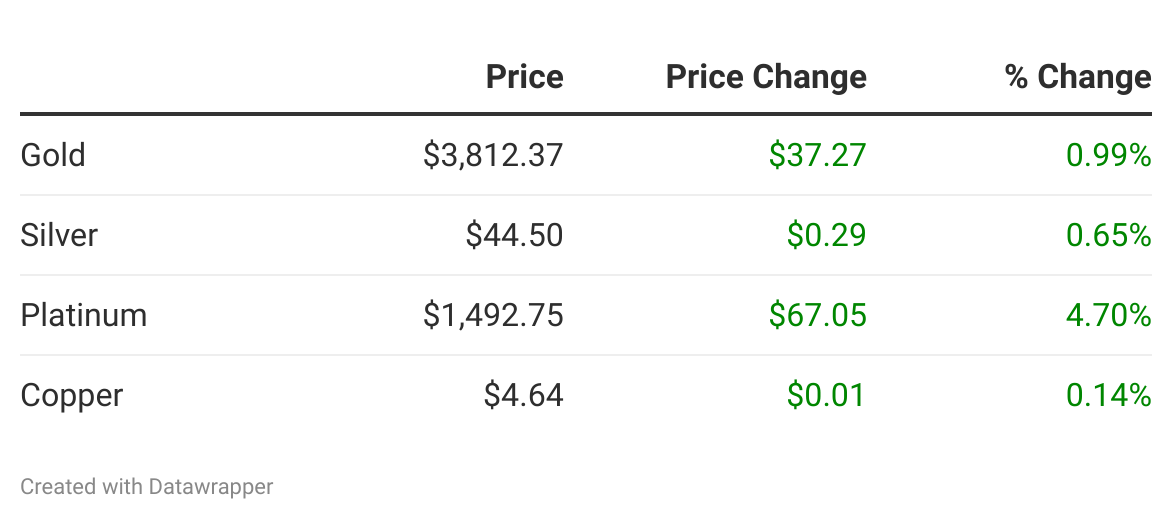

The Technicals: Silver Catches Up, Both Metals Have Many Bullish Indicators

This analysis attempts to look at different metrics to understand the current momentum in the gold and silver markets. It is meant as an analysis on potential price direction in the very short-term (a few weeks to 1-2 months). Read on »

China Moves To De-Westernize Global Bullion Market

Bloomberg reports that The People’s Bank of China is using the Shanghai Gold Exchange to court central banks in friendly countries to buy bullion and store it within the country’s borders, said the people, who spoke on condition of anonymity as the discussions aren’t public. The effort has taken place over recent months and has attracted interest from at least one country, in Southeast Asia, the people said. Read on »

Community News

Indian Gold Imports Hit 9-Month High in August With Resilient Demand Link>>

Gold and Silver Are Soaring. A Different Metal Is About to Break Out. Link>>

Asteroid Mining: The Quadrillion Dollar Resource Race Link>>

China’s relentless gold accumulation will keep prices in a decade-long uptrend Link>>

Next-Gen Battery Capacity by Country in 2025 Link>>