Good Reads

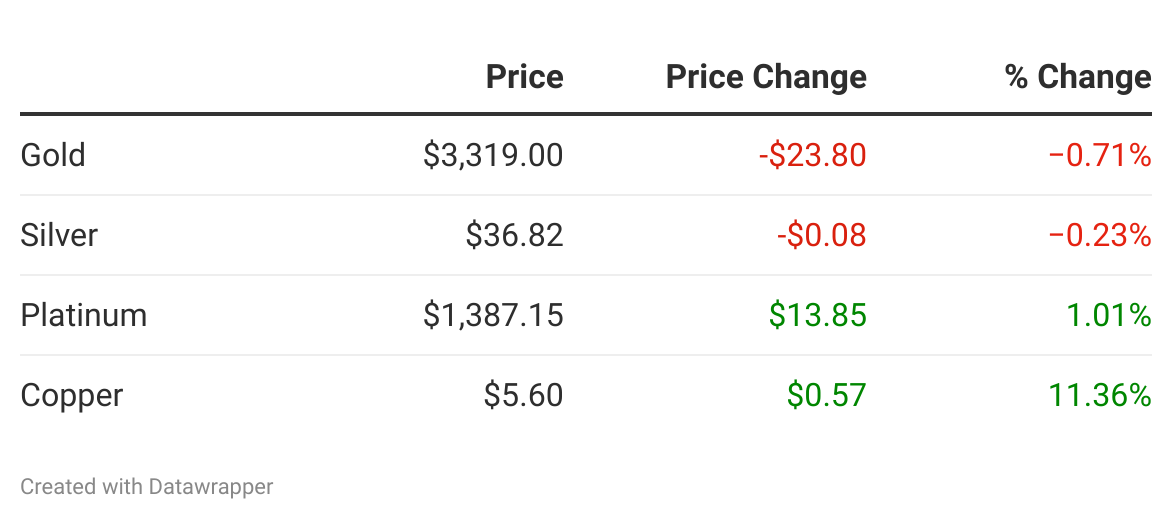

Energy Transition Fuels Bullish Outlook for Industrial Metals

With industrial use dominating demand for silver and copper, and platinum supply under stress from South African output drops, 2025 has brought renewed attention to metal markets. Production shortfalls, rapid electrification, and a slow mining cycle are helping drive prices up, even as economic headwinds and trade disputes create short-term volatility. Read on »

De-Dollarization Boosts Global Gold Demand

Rapid de-dollarization and global reserve diversification are fueling renewed gold demand in 2025. Southeast Asia and BRICS economies are increasingly trading in local currencies, reducing dollar reliance. Meanwhile, central banks and retail investors alike are loading up on gold, which now accounts for nearly 20% of reserves—a level not seen since the 1960s. Read on »

Gold as Protection from Currency Collapse

As the U.S. dollar continues to lose purchasing power—down nearly 99% since 1965—gold remains one of the only assets offering consistent protection. Sixty years after silver was removed from coinage, gold’s insurance role is increasingly vital. Investors are turning to precious metals not for speculation, but as long-term monetary preservation. Read on »

Community News