Good Reads

The gold ‘fear trade’ is on

Keynote speaker Frank Holmes, CEO of U.S. Global Investors, often kicks off resource investment conferences talking about the “fear trade” and the “love trade” in gold. Holmes is saying there are two demand drivers for gold. The fear trade has to do with demonetization, currency destruction, and negative real interest rates (interest rates minus inflation). The love trade is motivated for demand for gold for special occasions. Read on »

Swiss Propose Investment in US Gold Refining

Feeling the weight of the Trump Administration’s tariff policy, Switzerland’s government is offering to encourage Swiss gold refiners to invest in the US gold refining industry. The Swiss are suffering under one of the highest Trump tariff rates globally. In effect since August 7, 2025, US officials say the 39 percent tariff on Swiss imports is necessary to address an estimated US$48 billion trade deficit. Read on »

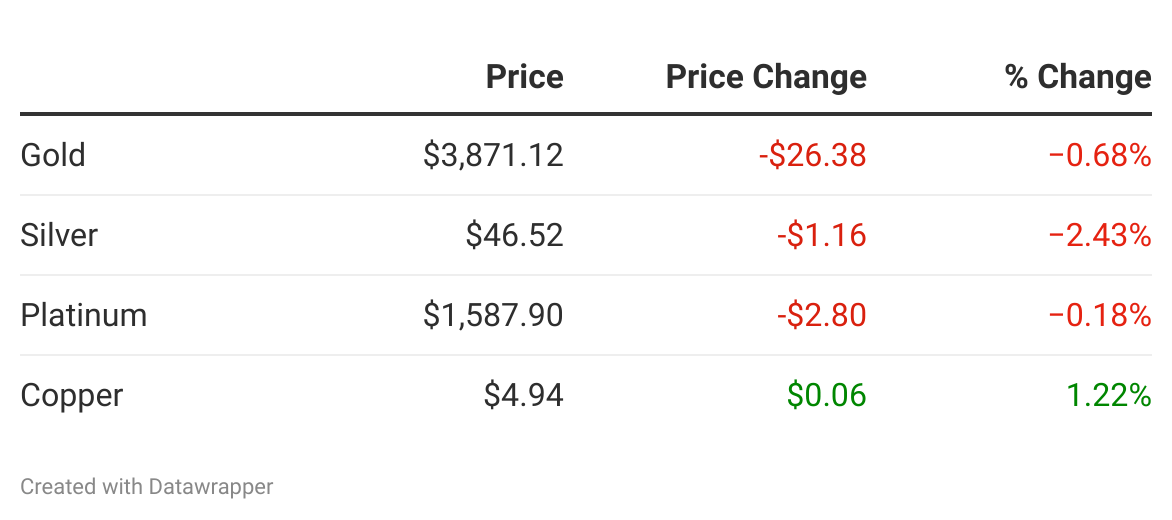

Gold and Silver Sink from New Records Amid US Jobs Data Gap

Gold and silver sank after hitting fresh all-time and 14-year highs respectively on Thursday as global stock markets rose to new records and the black-out of official US data caused by the government shutdown left traders and investors tracking private-sector job market estimates instead. After reversing an overnight 1.1% drop for yesterday's fresh highs, gold prices peaked within $4 per Troy ounce of $3900 before losing 1.8% in barely an hour to $3830. Read on »

Community News

Capital Gains Taxes on Houses Link>>

Gold Drops as Dollar Gains, Investors Take Profits After Rally Link>>

Here's Where Gold & Silver Stand Now Link>>

The US Bond Market has now been in a drawdown for 62 months, by far the longest in history Link>>

🧵 If you're trying to understand why gold is going parabolic… Link>>