Good Reads

Gold’s Value Driven by Sentiment

Unlike stocks or bonds, gold’s fundamentals don’t shift quickly. Its supply rises predictably, while demand changes erratically. Jewelry markets, ETF growth, and misconceptions about gold’s stability have fueled past rallies. Yet analysts stress much of gold’s price movement is sentiment-driven speculation, prone to reversing just as quickly as it rises. Read on »

The Global Illegal Gold Rush

Gold’s record rally is driving a dangerous black-market boom. Armed groups in South Africa, drug cartels in Colombia, and militias in Sudan are all cashing in on illicit mining. The trade finances wars, devastates indigenous communities, and destroys rainforests, while launderers in the UAE and Switzerland legitimize billions in smuggled metal. Read on »

France Faces Crisis Risks as Debt, Politics Pressure Eurozone Stability

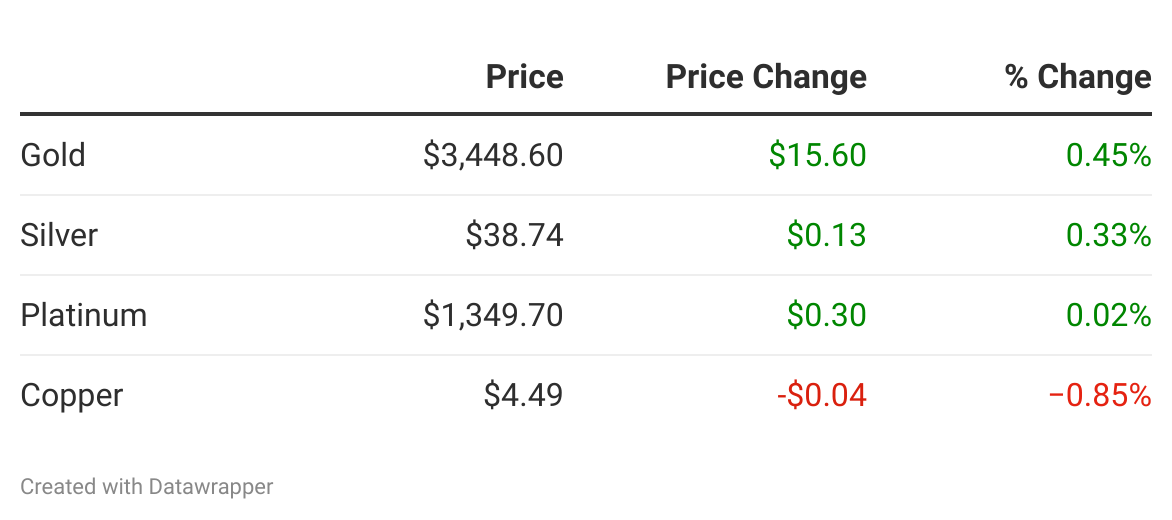

France’s financial and political strains are intensifying. The government faces a pivotal confidence vote, bond yields are spiking, and the banking system is heavily exposed to sovereign risk. Analysts warn the ECB may be forced into massive interventions, but political resistance and social unrest complicate support. In this climate, gold and silver’s safe-haven appeal strengthens. Read on »

Community News