Good Reads

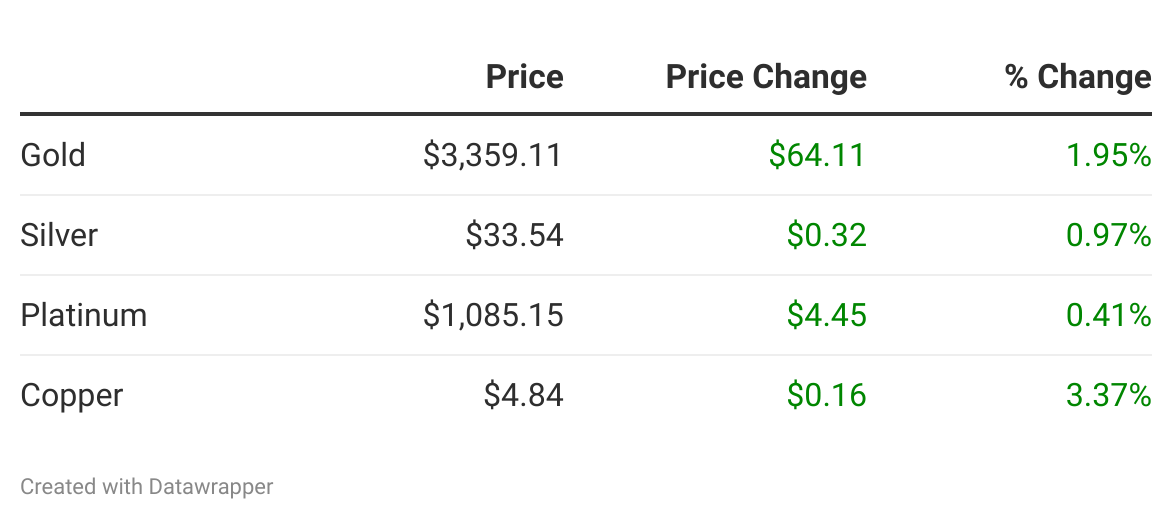

Gold Shines as Bonds Struggle

Bond markets are flashing red as the U.S. faces weak Treasury demand and Japan’s long yields surge, undermining decades-old assumptions about debt financing. Investor confidence is fading, sentiment is collapsing, and gold is reemerging as a haven. A new era of higher yields and reluctant buyers could challenge asset allocations. Read on »

Copper Split Signals Big Upside

Copper prices are diverging between the U.S. and global markets as tariff talk, credit tightening, and stockpile migration reshape the metal's dynamics. CME futures now trade at a rare premium to LME, echoing a 1960s split that led to mine nationalizations and long-term windfalls for early-positioned investors. Read on »

Gold Balances Portfolio Risk

The historic negative correlation between stocks and bonds has flipped positive due to persistent inflation, eroding the traditional diversification benefits. New research shows that portfolios require higher allocations to gold to maintain the same level of risk. Gold emerges as a key stabilizer in this evolving market environment, especially under stagflationary threats. Read on »

Community News