Good Reads

Commodity Supercycle Begins Now

History suggests every major commodity bull market begins with a shift in global monetary regimes. Today’s suppressed volatility, extreme leverage, and tech stock dominance echo past bubbles. The rumored “Mar-a-Lago Accords” could mark the next inflection point—triggering a dollar devaluation and launching a new supercycle in commodities and natural resource equities. Read on »

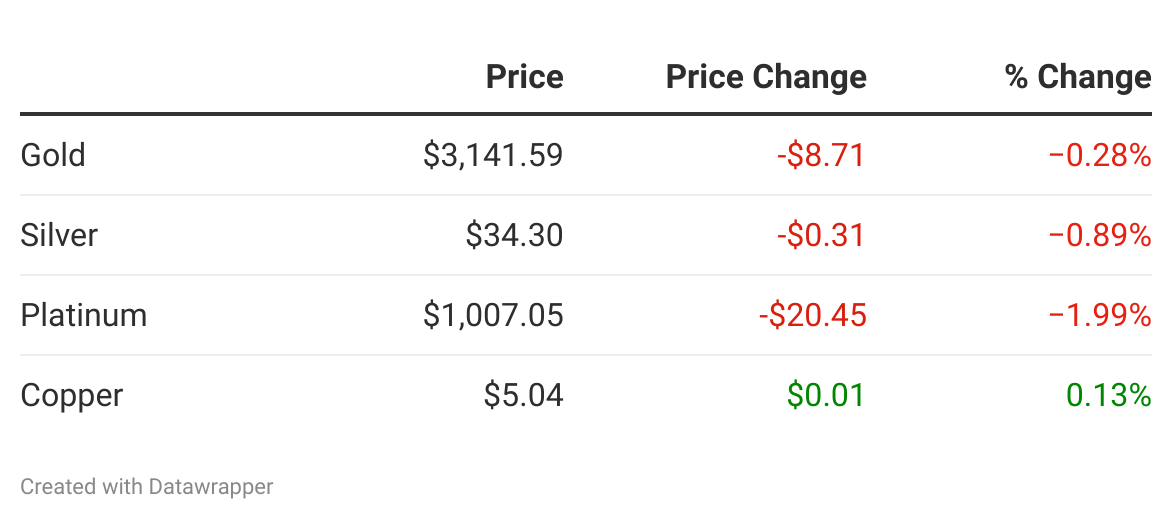

Gold Rallies as Investors Flee to Safety Before April 2

Gold pushed through its March 20 record, as investors brace for escalating trade tensions. While gold remains technically overbought, risk-off flows, geopolitical concerns, and anticipation around April 2’s tariff policy are fueling demand. Silver, meanwhile, is lagging slightly as industrial demand softens and the gold:silver ratio widens again. Read on »

Silver Lags Despite Gold’s Surge

While gold rockets to new highs on safe-haven buying and geopolitical fears, silver continues to lag, facing resistance between $34.87–$35.40. Weaker Chinese industrial signals and muted central bank demand are suppressing upside. Read on »

Community News