Good Reads

Precious metals start 2026 strong on rate-cut optimism, global risks

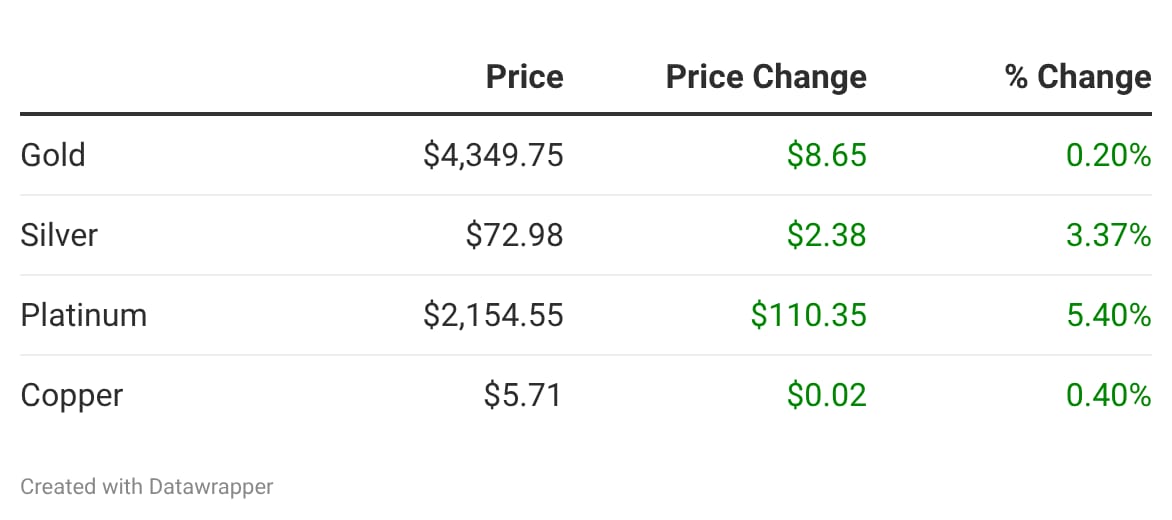

Precious metals kicked off the New Year on a strong note on Friday, rebounding from year-end declines as tensions between major powers and U.S. rate cut hopes boosted investor appetite for bullion. Spot gold climbed nearly 2% to $4,397.66 per ounce, as of 1102 GMT, after hitting a record high of $4,549.71 on December 26. It had dropped to a two-week low on Wednesday. Read on »

China Loves Silver: Déjà Vu All Over Again

History, as they say, doesn’t repeat itself, but it often rhymes. And right now, the precious metals market is hearing a familiar, resonant rhyme from the East—one that echoes with the weight of silver bullion and the resolve of a nation determined never to be humiliated again. Read on »

Oil is Flashing the Same Signal It Did Before the 2014 Crash

The last time oil looked this boring, it crashed 70% over the next 18 months. WTI has traded sideways for six months now, where every rally fades. Every dip gets bought. Goldman Sachs even turned bearish and most traders have moved on. We’ve been cautious too. But the supply data just changed and it’s flashing the same warning it did in late 2014. That warning preceded the best contango trade in a decade. Read on »

Community News

Silver and Gold Jump Amid Volatile Rally. Watch These Mining Stocks Link>>

US Sanctions Chinese Companies, Tankers With Venezuela Links Link>>

Gold skyrocketed in 2025. Silver outperformed it, and it wasn’t close Link>>

Bernie Sanders and Ron DeSantis speak out against data center boom Link>>

Why copper, silver and gold? Link>>