Good Reads

UBS Predicts Gold's Big Rise

UBS projects gold will hit $2,900 by late 2025 as global uncertainty, diversification demand, and central bank buying support long-term gains. Miners like Northern Star, Perseus, and De Grey Mining stand out as strong performers, with robust balance sheets and free cash flow growth expected to drive investor returns amid rising gold prices. Read on »

The World’s Biggest Buyers of Gold Are Now Among East European Central Banks

Eastern European nations, led by Poland, Hungary, and Serbia, are intensifying gold purchases to counter geopolitical risks and inflation. These moves solidify their reserves, hedge against global turbulence, and highlight gold's enduring safe-haven appeal. Central banks' increased demand is driving the metal's rally, with prices projected to surpass $3,000 by 2025. Read on »

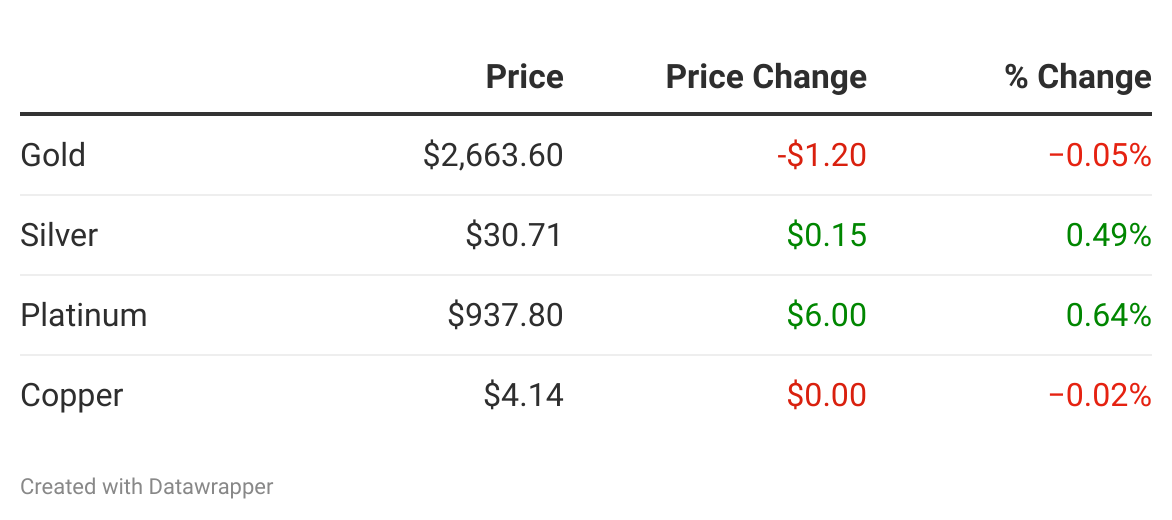

Gold Decline "Merely a Stumble”

Gold's post-election drop raised investor concerns, but analysts call it a temporary stumble. Goldman Sachs projects a rally to $3,150 by 2025, citing central bank demand, inflation risks, and geopolitical uncertainty. With structural and cyclical drivers intact, this dip may offer an opportune moment to "go for gold." Read on »

Community News